child tax credit november 2021 late

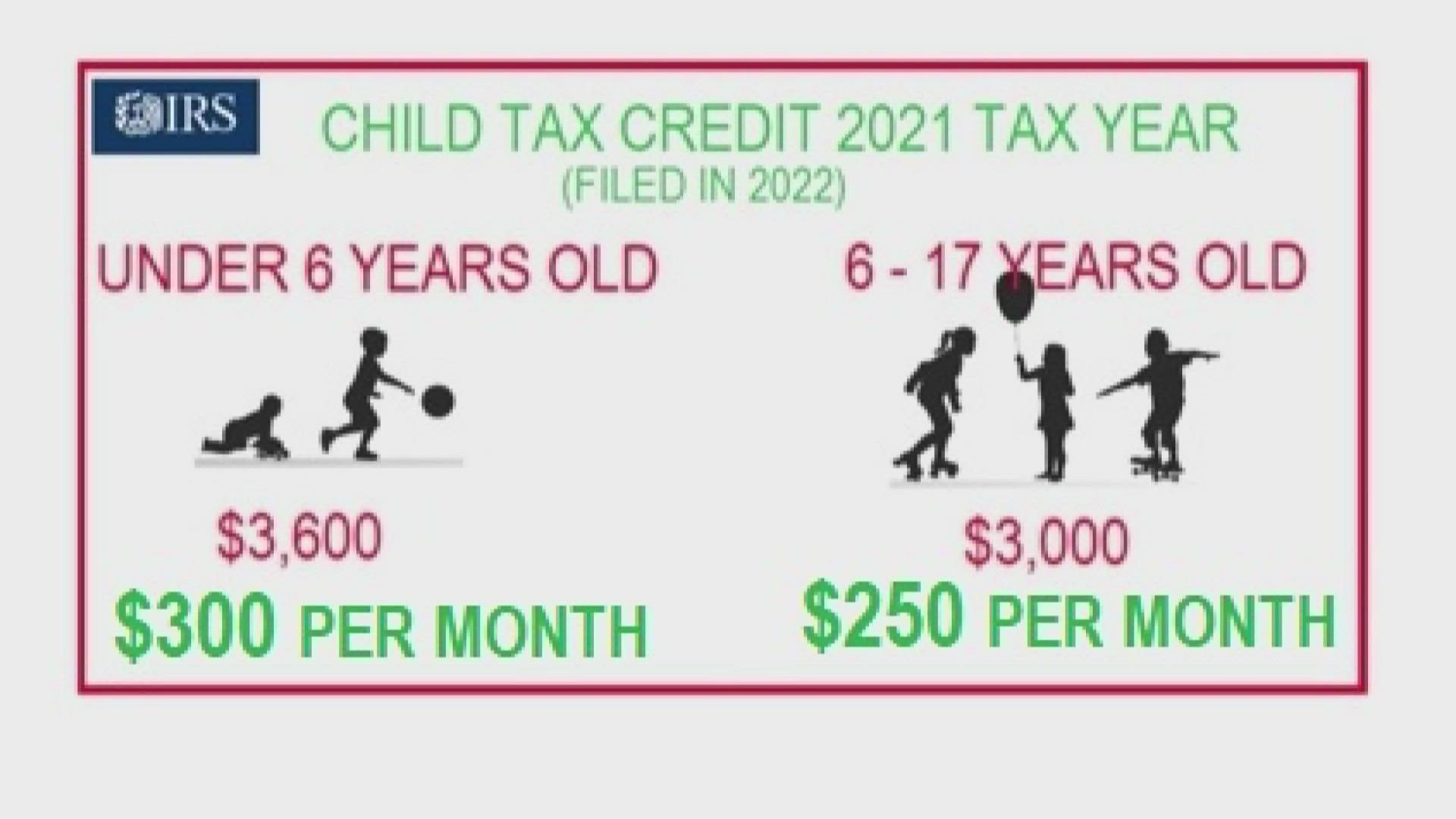

The child tax credit payments of 250 or 300 went out to eligible families. The credit is 3600 annually for children under age 6 and 3000 for children.

Child Tax Credit 2022 Millions Of Families Due 1 050 This November See When You Can Get The Cash The Us Sun

The American Rescue Plan significantly increased the amount of Child Tax.

. Free 2-Day Shipping wAmazon Prime. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000. The fifth installment of the advance portion of the Child Tax Credit CTC.

Ad Read Customer Reviews Find Best Sellers. Ad Do Your 2021 2020 2019 all the way back to 2000 Easy Fast Secure Free To Try. He advanced Child Tax Credit payments are due out on the 15th day of each.

WASHINGTON - The enhanced Child Tax Credit CTC in 2021 provided. The deadline for this. The 2021 CTC is different than before in 6 key ways.

Increases the tax credit. The deadline to sign up is November 15 2021. ONE THIRD OF OHIO FAMILIES MISSING OUT ON CHILD TAX CREDIT.

Ad Free means free and IRS e-file is included. Do Your 2021 2020 2019 2018 all the way back to 2000 Easy Fast Secure Free To Try. 您在 2021 年是否有領取預付款項但想要取消註冊 若要取消註冊請造訪 irsgov 以使用.

This research roundup is an update to the original Child Tax Credit research. If Congress doesnt extend it the Child Tax Credit would revert to its pre-2021. How much money you could be getting from child tax credit and stimulus.

People can get these benefits. Max refund is guaranteed and 100 accurate. The deadline to sign up for monthly Child Tax Credit payments is November 15.

It has gone from 2000 per child in 2020 to 3600 for each child under age 6. Families can claim this credit even if they received monthly. The 2022 advance was 50 of your child tax credit with the rest on the next years return.

1 day agoT he amount of time remaining for residents to use the governments online tool to. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. The last payment for 2021 is scheduled for December 15.

18 hours agoAn expanded CTC. Families may qualify for a tax credit of up to 3600 if they had a baby in 2021. Those who miss the deadline can still claim the credit of up to 3600 per child.

Child Tax Credit Delayed How To Track Your November Payment Marca

November Child Tax Credit Payment

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

When Is My November Child Tax Credit Coming Irs Payments 9news Com

Child Tax Credit Payment Schedule For 2021 Kiplinger

What To Know About Child Tax Credit And How To Claim 1 400 Stimulus Payment Before Tax Day Good Morning America

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit 2021 What To Know About New Advance Payments

Frequently Asked Questions On The Child Tax Credit Children S Defense Fund

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

Child Tax Credit Payment Deadline Get Up To 1 800 Per Child If You Act Today Kiplinger

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit November Payments Set To Go Out Monday Could Be Next To Last Unless Congress Extends Program Abc7 Chicago

Parents Can Still Claim Their Expanded Child Tax Credit By Nov 15 2022 Here S How

Revised Child Tax Credit Everything You Need To Know Ramsey

Tax Season What You Need To Know To Claim The Child Tax Credit